Discovering New York Residential Property Investment Opportunities: A Comprehensive Guide

New York City State is just one of one of the most vibrant real estate markets in the world, offering diverse home investment chances. From the busy streets of New York City to the peaceful landscapes of Upstate New york city, financiers have the possibility to take advantage of a large range of markets, each with its own one-of-a-kind possibility for returns. This overview will certainly stroll you with the crucial residential property financial investment chances in New York and help you make notified decisions to optimize your economic development.

Why Purchase New York Property?

1. Economic Toughness and Security: New York State, particularly New york city City, is a international monetary hub and boasts among the greatest economic climates in the world. The state's economic variety, with markets like finance, innovation, healthcare, and tourist, gives a steady environment genuine estate investments. This economic toughness contributes to consistent need for properties, making New york city an appealing market for both residential and business realty.

2. High Demand Throughout Markets: New York's varied landscape implies there's something for every kind of investor. Whether you want metropolitan properties in New york city City, vacation leasings in the Hamptons, or multifamily homes in Upstate New York, there's a continuous demand for residential properties across the state. High rental need, reduced job prices, and home admiration capacity make New york city an perfect area for real estate financial investment.

3. Long-Term Property Gratitude: New york city real estate has traditionally shown stable recognition, particularly in essential locations fresh York City, Long Island, and Westchester. Regardless of regular market fluctuations, property worths tend to climb gradually, making it a solid long-term financial investment alternative. Investors wanting to develop wide range with time can benefit from both rental income and the gratitude of residential property worths.

Top Residential Or Commercial Property Investment Opportunities in New York

1. New York City City: Purchasing New york city City property is a desire for several investors. The city's constant demand for residential and commercial residential or commercial properties makes it a prime target for home financial investment. While costs can be high, the prospective returns are considerable. Areas like Manhattan and Brooklyn are hotbeds for luxury condos, rental apartments, and commercial real estate. Queens and the Bronx also offer financial investment possibilities in multifamily buildings and mixed-use growths.

Residential Rentals: With a populace of over 8 million, New york city City regularly sees high demand for rental residential or commercial properties. Capitalists can anticipate strong rental returns, particularly in high-demand neighborhoods like Midtown, Chelsea, and Williamsburg.

Luxury Realty: Manhattan's high-end market continues to flourish, with wealthy customers from around the world looking for premium homes. Investing in deluxe condominiums or penthouses in prime places can result in high returns, though the access expenses are steep.

2. Long Island and the Hamptons: Long Island, consisting of the Hamptons, is one more leading real estate financial investment location. The area is understood for its gorgeous coastlines, upscale communities, and closeness to New York City. Trip leasings and second homes in the Hamptons are specifically rewarding, especially throughout the summer season.

Trip Leasings: The Hamptons is a hotspot New York property investment opportunities for trip services, with residential properties in prime areas fetching high rental rates during top tourist periods. Investors can profit from short-term vacation services by satisfying the demand from wealthy vacationers.

3. Upstate New York City: Upstate New York supplies a different financial investment account compared to the city, with reduced home rates and higher rental returns. Cities like Albany, Buffalo, and Rochester are experiencing revitalization, making them ideal locations for capitalists trying to find economical residential properties with growth capacity.

Multi-Family Residences: Upstate cities like Buffalo and Rochester offer superb opportunities for buying multifamily residential properties. These residential or commercial properties are usually more inexpensive than those in New York City and offer strong rental yields, making them a great choice for financiers searching for cash flow.

Trip Homes: The Finger Lakes and Adirondacks regions are preferred holiday locations, using chances for investment in holiday services. Feature in these locations often satisfy tourists seeking lakeside homes, cabins, or homes, giving a steady rental revenue.

4. Westchester Area: Simply north of New york city City, Westchester Area supplies a country way of living with distance to the city, making it a preferable area for family members and travelers. The area boasts outstanding schools, affluent areas, and accessibility to outside activities. Real estate in Westchester is in high need, specifically single-family homes, making it a solid market for residential financial investments.

Suburban Services and Flips: Westchester homes are perfect for investors curious about either lasting leasings or house turning. The region's high demand for homes, incorporated with strong residential or commercial property appreciation, supplies strong Green Springs Capital Group returns for investors.

5. Hudson Valley: The Hudson Valley is just one of the fastest-growing areas for real estate financial investment in New York. This area, located just north of New york city City, is known for its breathtaking landscapes, captivating towns, and expanding appeal as a weekend break trip or a irreversible home for city dwellers.

Residential and Holiday Residences: Towns like Beacon, New Paltz, and Rhinebeck use unique financial investment opportunities for villa and domestic services. With its growing allure for remote workers and tourists, Hudson Valley is ending up being a hotbed for investment.

Secret Factors To Consider for Purchasing New York City Residential Or Commercial Property

1. Market Research: Before investing in any residential property, detailed market research is vital. Comprehending regional market fads, home worths, rental need, and economic aspects will certainly help you make better investment choices. Each area in New York has distinct market characteristics, and recognizing where to invest will make a huge distinction in the returns you achieve.

2. Diversify Your Profile: New york city State offers diverse financial investment options, from city rental homes to country villa. Expanding your profile by buying different types of New York property investment opportunities homes throughout numerous locations can decrease danger and make best use of lasting returns.

3. Take Into Consideration Long-Term Potential: New York's realty market can be extremely competitive and expensive, particularly in prime areas. Financiers must take a lasting sight, concentrating on both rental returns and prospective residential property recognition gradually. This technique makes sure that your financial investment grows steadily while generating recurring revenue.

4. Utilize Tax Benefits: New york city provides a number of tax incentives genuine estate capitalists, especially in Chance Zones, which encourage advancement in financially distressed areas. Working with a tax obligation expert familiar with New York's tax codes can assist you maximize your investment benefits.

New York property financial investment chances span from the deluxe markets of New york city City to budget-friendly, high-yielding homes in Upstate New York and past. Whether you're trying to find long-term household leasings, short-term holiday homes, or commercial realty, New York supplies a diverse and secure investment setting. By thoroughly researching the marketplace, identifying high-demand locations, and leveraging long-term capacity, you can achieve considerable returns in among the most vibrant real estate markets worldwide.

Kel Mitchell Then & Now!

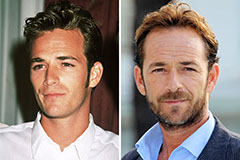

Kel Mitchell Then & Now! Luke Perry Then & Now!

Luke Perry Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! David Faustino Then & Now!

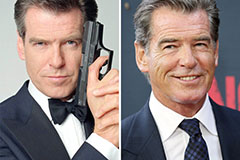

David Faustino Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!